Fixed v's Variable

This is a question that is asked by friends and clients on a regular basis. Before choosing one or the other, first of all it is important to understand the difference and the mechanics of both of them and what impact they can mean to you and your mortgage. Another important factor is the RBA cash rate and the banks standard variable rate.

The Reserve Bank of Australia and the bank standard variable rate

It is important to know with all rates not just variable, that although the RBA may reduce rates (most commonly in increments of 0.25%) the lender you are with may not pass on that full cut. This is a topic that has been in the media quite a lot in recent times as none of the major lenders have passed on the full RBA cut in the December decrease and this has been quite a common theme in the majority of the other three cash rate decreases in 2012 (The cash rate dropped a total of 1.25% in 2012). The banks normally make their decision within 2-3 days of the RBA decision and pass on their decision a couple of weeks later. At present the only major bank that reviews their rates independently is the ANZ, which announce their reviews on a monthly basis. Media reports state that the other major banks will follow suit in this approach.

Currently the cash rate is at it lowest in over 3 years with NAB forecasting three more cuts in 2013 NAB Economist tipping three more cuts in 2013. The last increase was in 2009 which had kept the cash rate at 3% for 3 months until its October increase.

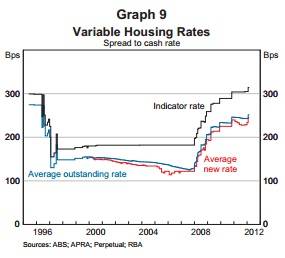

At present the gap between the RBA cash rate and the banks standard variable rate is the greatest it has been in 19 years with the banks blaming the cost of off shore funding for this.

Variable rate mortgage

A variable rate mortgage will move up and down with the Reserve Bank of Australia (RBA) decision on their cash rate and therefore is also commonly known as a floating rate. The variable rate is the most common type of mortgage in Australia and the one most potential borrowers look at when searching for finance. The variable rate loan normally has many features linked to it such as an offset account, redraw and the ability to pay off additional funds with no extra charge. You normally have the ability to pay out your mortgage without a large fee. The Australian government has recently imposed new laws so lenders can not charge high exit fees, although these have stopped the lenders still impose a fee of approximately $250-$350 as a "legal" or "administration" fee.

Fixed rate mortgage

As the name suggests these mortgages are fixed for a certain period of time, most borrowers choose fixed rate periods of between 2-5 years. This rate will mean that you have the same repayment regardless of the RBA decisions. This can either work for you or against you depending on which way the cash rate goes. With a fixed rate loan you are normally limited to paying off additional funds on top of your minimum amount and if you wish to terminate the mortgage early you could be up for large exit fees. These fees will depend on the amount of the loan, the term left, the rate agreed and the current bank standard variable rate. This type of mortgage should not be an option if you are considering refinancing to another lender in the fixed rate time frame or selling your property without having another property to purchase within a few months of selling. Many lenders will offer a portability option as a feature, which means you can transfer your mortgage to another property. This feature is important if you are thinking to lock in your rate and switch property.

Combination of Fixed and Variable

Quite a common option for borrowers is to have a portion of the loan as variable and a portion as fixed. This provides the option to pay extra salary and extra cash into the variable portion to save interest and also provides a portion of the loan as fixed which will provide certainty of repayments.

What should you do

It is near impossible to know where the bottom is but by researching as much as possible in the media and by following economists forecasts should start to give you a better idea of if and when you should be looking at fixing a portion of your mortgage if you desire. Also follow CBM Mortgages on twitter for latest relevant articles we post on our home page to see the twitter feed. Prior to this you should contact CBM Mortgages and see what different lenders are offering in terms of their fixed rates as there can be a big spread between lenders. As of today we have one lender offering a 2 year fixed rate starting from 4.99% (dependant on loan amount and lending to value ratio). For more information go to our contact page.